Best Tips About How To Find Out The Equity In Your Home

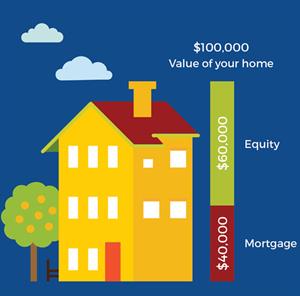

For example, if your current balance is $100,000 and your home’s market value is.

How to find out the equity in your home. This means that home equity loan rates, for example, are typically between 3% and 12%, depending on the lending institution, the loan amount, and the credit worthiness of the. To calculate your home’s equity, divide your current mortgage balance by your home’s market value. You can find the current balance on your monthly mortgage statement.

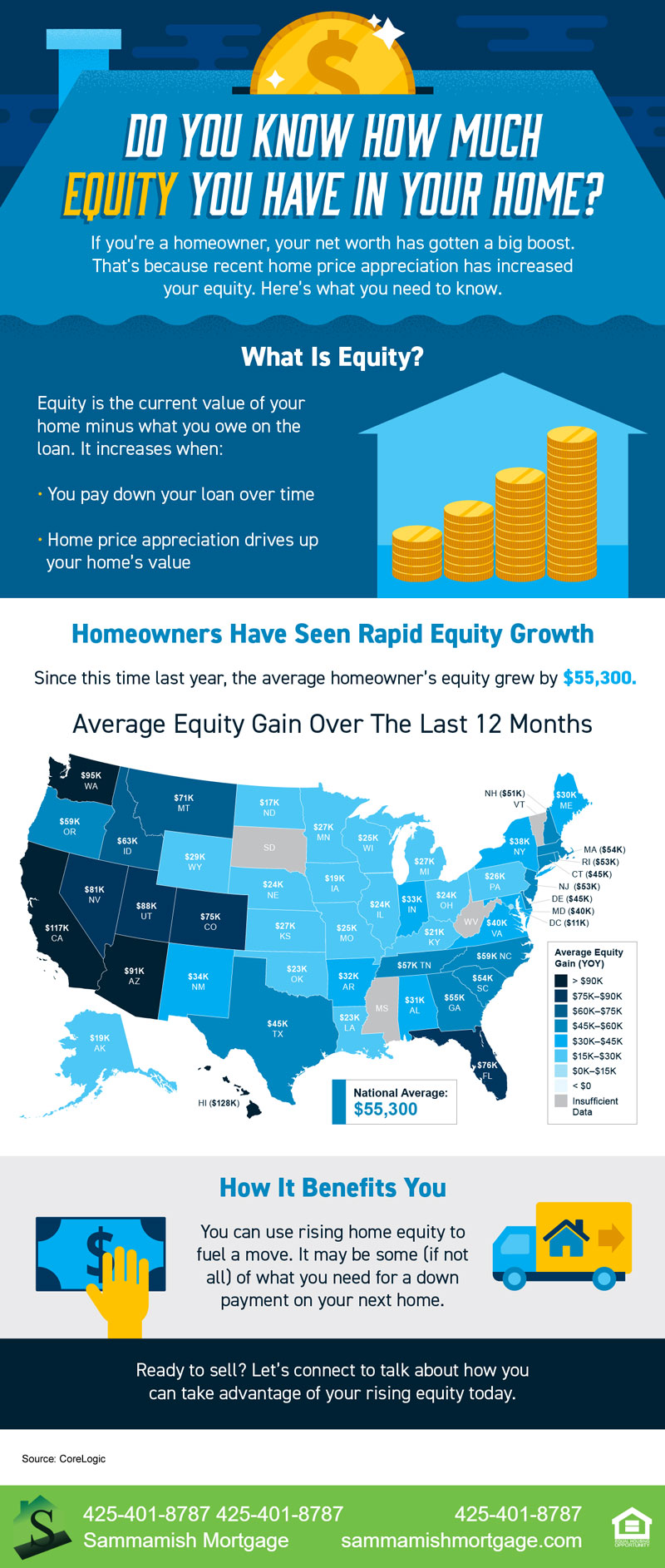

Ad the average american has gained $48,000 in equity in the last 5 years. Get the best heloc for you. In a nutshell home equity is your home’s market value minus how much you owe on your mortgage.

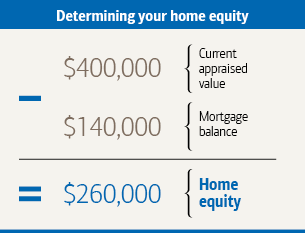

You can calculate your equity by taking your home’s current value and subtracting your remaining loan balance. Ad put your home equity to work & pay for big expenses. Costs $0 to see savings.

The price you paid for your home may not be the current value of your home. How to calculate home equity 1. To get the percentage, the homeowner would need to divide the loan balance by the current market value and multiply it by 100.

Apply now & find a cheaper way of borrowing cash! If your home is currently valued at $300,000, subtracting the amount owed from the home’s value equals your available equity: For example, if a home is worth $300,000 in the.

Ad if your home's worth at least $150k, and you have at least 50% home equity, we can help. Many or all of the companies. To figure out how much equity you have in your home, subtract the amount you owe on all loans secured by your house from its appraised value.

/homeequityloan-final-542ee28789b642b7a78b7b77dd6dbfc6.png)