Sensational Tips About How To Choose Renters Insurance

Ad the most reliable renters insurance providers that will spare you from unexpected expenses.

How to choose renters insurance. If you opt for the higher deductible, you’ll pay less monthly on premiums. Here are some tips that can help! Liberty mutual insurance company is an insurance company which offers coverage for individuals, families, and businesses.

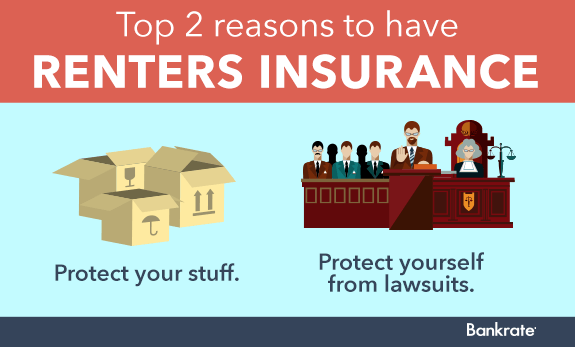

Choosing renters insurance is a big deal. If you are a renter, insurance for your rental property keeps your stuff protected. Renter’s insurance can help to protect your possessions and personal interests.

All you need to know is how to calculate the amount of coverage you require and how to get a good rate. The most common discounts include: However, you’ll have to pay that.

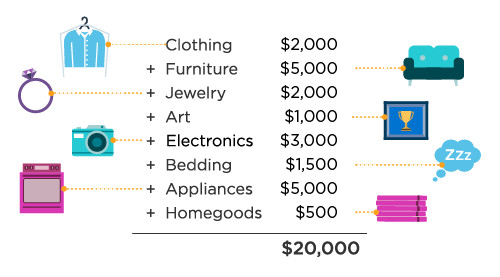

Renters insurance is designed to cover the cost of replacing your belongings in the event of an accident, theft or natural disaster. In california, the estimated price of renters insurance is $204 per year or around $17 per month. When selecting a policy, look at companies that use their own agents, those that use independent agents who refer clients to more than.

Be sure to ask about any discounts that may be available, such as those for. Ad cover your property, belongings & more. Why you need renter’s insurance.

Compare quotes from top carriers & apply online now. Here are a few tips to help you choose renter’s insurance. Choose a renters insurance company.

:max_bytes(150000):strip_icc()/Renters-insurance-4223009-final-a125edb41c2f4a4a980ef2cf069d7723.png)

:max_bytes(150000):strip_icc()/whats-difference-between-renters-insurance-and-homeowners-insurance-v2-2694bc76e944405aa55fe2784c373999.png)

/Renters-insurance-4223009-final-a125edb41c2f4a4a980ef2cf069d7723.png)